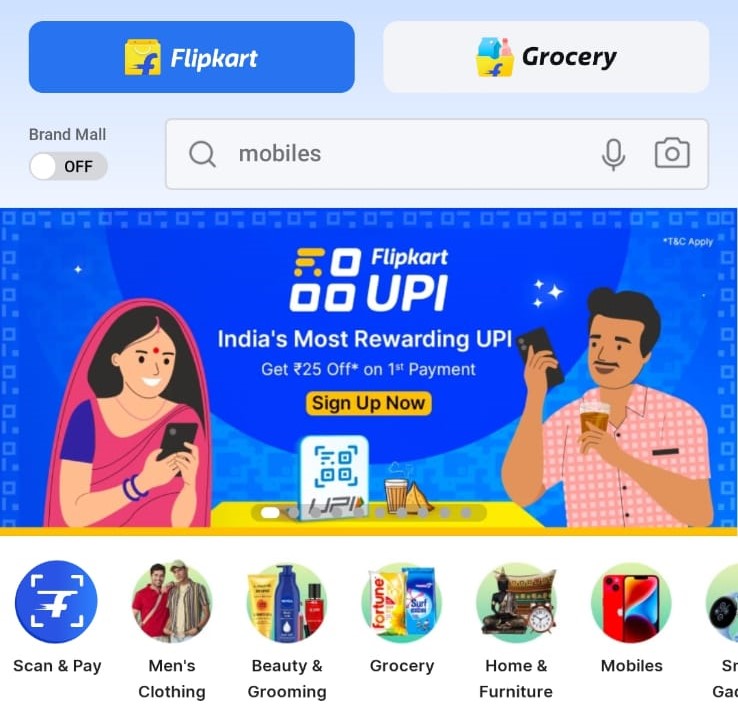

In a move to further strengthen its digital payment offerings and tap into the booming Indian digital payments market, e-commerce giant Flipkart recently launched its own Unified Payments Interface (UPI) handle for Android users. This new service, dubbed “@fkaxis,” is a collaboration with Axis Bank and aims to provide a convenient and rewarding payment experience for Flipkart’s massive user base of over 500 million customers.

Flipkart Joins the Fray: Offering “@fkaxis” with a Twist

Flipkart’s entry into the UPI space signifies its ambition to become a one-stop shop for all things digital, not just online shopping. The “@fkaxis” handle offers users a convenient way to make online and offline payments within and outside the Flipkart platform. Additionally, Flipkart aims to differentiate itself by integrating its loyalty program, Supercoins, with “@fkaxis.” This integration allows users to earn Supercoins on every UPI transaction, further incentivizing them to adopt the new service.

Benefits for Users: Convenience, Rewards, and More

The launch of “@fkaxis” presents several advantages for Flipkart users:

- Convenience: Users can now make payments and transfer funds directly within the Flipkart app, eliminating the need to switch between different platforms.

- Rewards: Earning Supercoins on every UPI transaction adds an attractive layer of reward, encouraging consistent usage.

- One-click payments: Flipkart promises a seamless experience for mobile recharges and bill payments within the app, simplifying these common tasks.

- Security: As UPI is a secure platform, users can be assured of the safety of their financial information.

Flipkart’s foray into UPI is a strategic move on multiple fronts. It strengthens the company’s position in the digital payments ecosystem, potentially attracting new users and increasing engagement within the Flipkart app. Additionally, the integration of Supercoins with “@fkaxis” fosters a stronger loyalty program, encouraging users to remain within the Flipkart ecosystem for various needs.

Furthermore, Flipkart has hinted at expanding the service to iOS users in the future. Additionally, the company aims to introduce new features like bill splitting and in-store payments through QR codes, further enhancing the functionality of “@fkaxis.”

Flipkart’s launch of “@fkaxis” marks a significant development in the Indian digital payments landscape. While the service is currently limited to Android users, it has the potential to become a major player in the UPI space, especially with its focus on convenience, rewards, and a seamless user experience. As Flipkart continues to innovate and expand its offerings, it will be interesting to see how “@fkaxis” evolves and shapes the future of digital payments in India.