Given its successful introduction in the United States four years ago, Apple is preparing to unveil the highly awaited Apple Card in India. The Apple Card seeks to revolutionise the way consumers manage their finances by providing a plethora of benefits that seamlessly combine Apple’s hardware and services. This article delves into the fundamentals of the Apple Card, from alluring cashback incentives to low-interest rate loans and a variety of other features.

What essentially is the Apple Card?

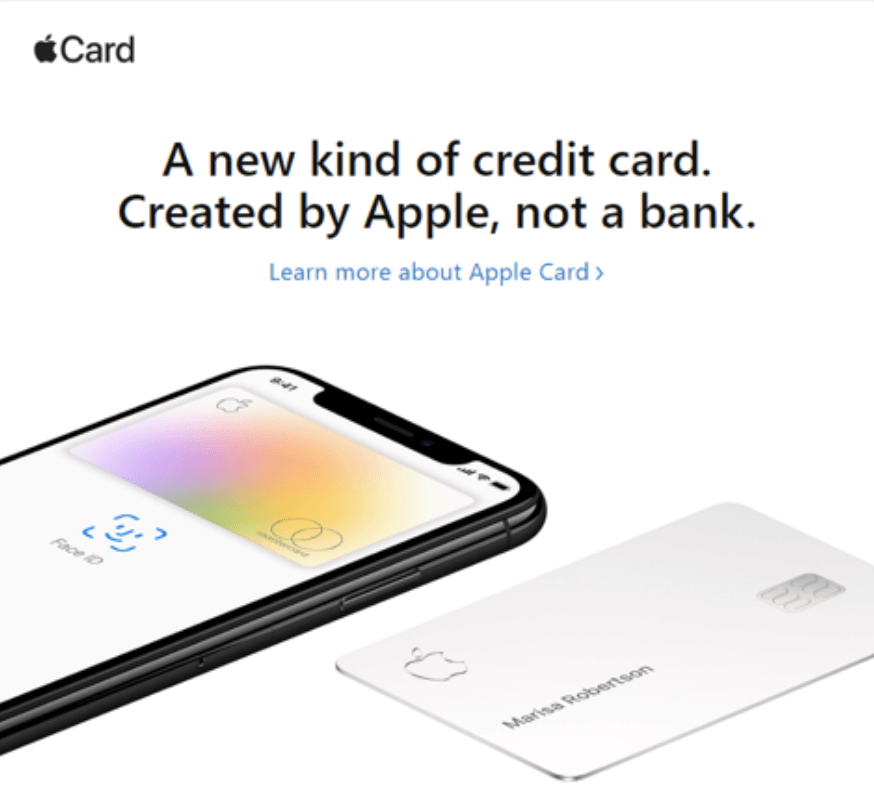

The Apple Card is a one-of-a-kind credit card created by Apple that allows consumers to live financially healthy lifestyles. It differs from typical credit cards in that it offers a variety of features that set it apart from competitors. In this post, we’ll look at the benefits of both the Apple Card and Apple Pay, both of which were previously accessible only in the United States but are soon coming to India.

Benefits of the Apple Card:

1. Daily Cashbacks :

The Apple Card offers customers up to 3% Daily Cashback on payments, with no fees attached. Users get 2% Daily Cashback on every transaction made with the Apple Card and Apple Pay. Users receive actual currency that may be spent, given, or stored with no points to calculate, constraints, or deadlines to worry about, letting their funds increase over time. Furthermore, purchases bought directly from Apple, including those made in Apple Stores, on the App Store, as well as for Apple services, qualify for a whopping 3% Daily Cashback.

2.No Fees :

The Apple Card’s pricing structure is one of its most notable aspects. It does away with yearly fees, late fees, over-limit costs, international transaction fees, and late payment fees. This reduced pricing scheme enables consumers to better manage their finances while eliminating unwanted expenses.

Incorporation of Advanced Security:

By including modern technologies such as Face ID, Touch ID, and Apple Pay, the Apple Card prioritises user security. These cutting-edge security methods offer more privacy and protection. Furthermore, the Apple Card uses machine learning & Apple Maps to validate transactions, safeguarding users’ financial security.

Incorporation of Financial Health:

The Apple Card enhances users’ financial well-being by providing better tools and greater transparency. The Apple Card helps consumers lower their interest payments by removing fees and providing unique spending control capabilities. Furthermore, it promotes savings while maintaining a better level of privacy and security. These features help Apple Card members and their families live a financially healthy lifestyle.

Few of the Benefits of Apple Pay:

a)Convenience-

Apple Pay is a simple and secure payment solution that eliminates the need for physical touch or currency exchange. Users may make purchases in shops, applications, and on the web with ease. Apple Pay’s rollout in India would considerably ease the purchase procedure for customers since it is accepted by 85% of retailers in the United States.

b)Security-

When compared to regular credit cards, Apple Pay offers greater security. Your credit card information is not saved on Apple’s servers when you use Apple Pay. Instead, an individual Device Account Number is encrypted and securely kept in your device’s Secure Element, providing a higher level of protection.

c)Daily Cashback-

Transactions conducted with Apple Pay using the Apple Card reward consumers with 2% daily cashback, giving them an exceptional opportunity to earn money back on their purchases.

d) User-Friendly Interface-

Apple Pay is an easy-to-use interface that allows customers to connect their credit or debit cards in a few simple clicks. They can quickly make payments with a single touch or look once added.

The debut of the Apple Card, as Apple develops its footprint in India, represents a big potential in the country’s financial environment. The Apple Card and Apple Pay have a number of advantages, making them a fantastic alternative for anybody looking for a credit card or payment mechanism.

Furthermore, Apple Pay’s ease, and security, including daily cashback, make it an excellent alternative for transactions in shops, applications, and on the web.

For more such updates, keep reading techinnews